In June 2014, the California Legislature made significant changes in contributions to the California State Teachers Retirement System. The CFT formed a task force to study the issue of the system’s “unfunded liability” and to submit the union’s recommendations to the governor and the Legislature. Learn about the changes passed by the Legislature and the union’s positions below.

CFT LETTER TO MEMBERS: June 21, 2014

CFT Members and Staff,

On June 15, 2014, the California Legislature passed Assembly Bill 1469 (Bonta) to address the CalSTRS projected $74 billion unfunded liability. The legislation, once signed by the governor, will make significant changes to the CalSTRS contribution rates for employees, employers and the state beginning July 1, 2014. While the final legislation was an improvement from Governor Brown’s initial proposal, the CFT’s leadership felt the requirement to achieve 100% funding was not in keeping with standard accounting practice which sees 80% funding as the gold standard. As a result, school districts must shift dollars away from vital educational needs including restoring programs and positions and much needed salary increases in order to comply with the increased retirement funding demands.

CFT Senior Vice President Lacy Barnes convened a task force that reviewed the issue and brought back recommendations to the Executive Council. The CFT leadership and staff actively lobbied the legislature and the governor on our position as well as testified on several occasions. In the end, the legislation that was passed was a compromise between the governor and the legislature that included some of the CFT positions.

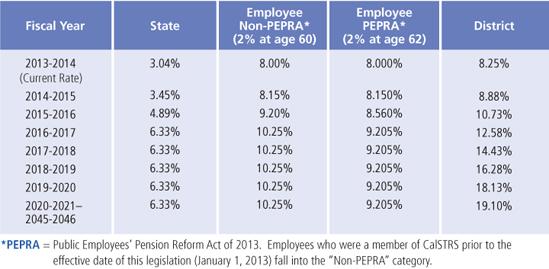

The new CalSTRS funding formula includes the following:

- Contribution increases for the employee and the state will be phased in over 3 years.

- Contribution increases for districts will be phased in over 7 years.

- The system will be funded at 100% in 32 years.

Additional provisions:

- The CalSTRS Board will have to report to the Legislature on or before July 1, 2019, and every 5 years thereafter, on the fiscal health of the Defined Benefit Plan and the unfunded actuarial obligation.

- Beginning July 1, 2014, the 2% “Improvement Factor” (also commonly referred to as the COLA) becomes a vested benefit for an active member in any calendar year in which the active member paid increased member contributions.

- For fiscal year 2017-2018 and each year thereafter, the CalSTRS Board has the authority to increase or decrease the state contribution by no more than 0.50% in a single fiscal year based upon a recommendation from its actuary.

- For fiscal year 2021-2022 and each year thereafter, the CalSTRS Board has the authority to increase or decrease the district contribution by no more than 1% in a single fiscal year up to a maximum of 12% based upon a recommendation from its actuary.

- State contributions will be made outside of Proposition 98.

We recognize that a secure and stable retirement is critical to the members of the organization. While the legislature and governor have taken steps to ensure that CalSTRS can continue to fully fund pensions for years to come, asking our members to shoulder more of the financial burden either directly or indirectly once again penalizes educators for a situation not of our making.

It is important to remember that the health of CalSTRS was not an issue until the financial crisis of 2007 caused by the unethical lending practices of America’s largest financial institutions not by anything our members did.

The CFT will continue to monitor the situation and advocate for changes that don’t unfairly burden our members and local districts.

In Unity,

Joshua Pechthalt

President, California Federation of Teachers

CFT LETTER TO GOVERNOR: May 30, 2014

While the governor and the Legislature were working on fixing the unfunded liability in the CalSTRS pension fund, the CFT submitted a letter stating its positions about what the union wanted to see changed in the governor’s plan.